Private Money Mortgage Loans

Franklin Mortgage Holdings offers an exclusive private money-bridge loan product designed to help investors close quickly on their next investment property. This solution provides the necessary time to transition to a Debt Service Coverage Ratio (DSCR) or conventional loan. Whether you choose to close in your personal name or under an LLC, our quick close option allows you to effectively compete with cash offers.

Our investment property bridge loans come with flexible terms:

- Loan Amount: $175,000 to $2,000,000

- Minimum Credit Score: Flexible

- Interest Rates: from 9.99%

- Points: 1-3%

- Payment: Monthly, interest only, no prepayment penalty

- LTV: Up to 75%

- Term: 6, 12, or 18 months

- Residential of Commercial Properties

Eligible loan types include purchase, refinance, and cash-out refinance. Our program specifically caters to investment properties, ensuring a streamlined and efficient closing process within 7-10 days. No prior experience is necessary, as we provide in-house underwriting and capital lending.

Our common sense underwriting focuses primarily on the value of the property, eliminating the need for tax returns, income verifications, or debt ratios to qualify. This approach significantly speeds up the loan approval process.

Private Money Mortgage Loans: Comprehensive Explainer

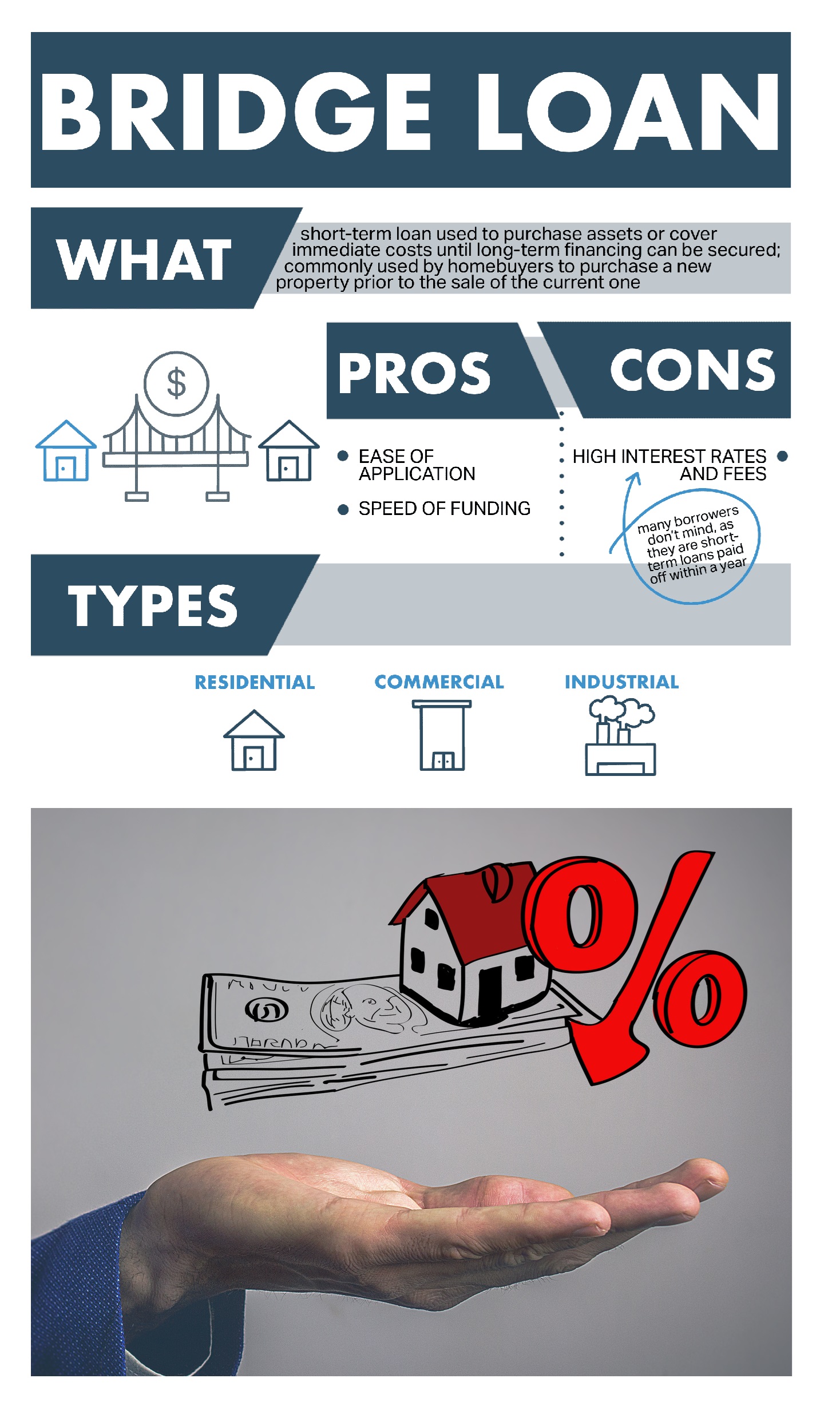

In the world of real estate lending, an increasingly popular financing option is Private Money Mortgage Loans. Also known as hard money loans, these loans are typically issued by private investors or lenders and are often used by borrowers who are unable to secure traditional bank financing for various reasons. In this comprehensive explainer, we’ll delve deeper into what Private Money Mortgage Loans are, how they work, and who they are best suited for.

What are Private Money Mortgage Loans?

Private Money Mortgage Loans are short-term bridge loans that are secured by real estate assets. Unlike traditional bank loans, which have strict lending criteria and lengthy approval processes, Private Money Mortgage Loans are underwritten by private investors who evaluate borrower applications on a case-by-case basis. These loans are typically used for real estate investment purposes, such as purchasing and rehabbing distressed properties, flipping houses, and acquiring rental properties.

How do Private Money Mortgage Loans work?

Private Money Mortgage Loans are not standardized like traditional bank loans. Instead, they are customized based on the borrower’s needs and the property being financed. Here are some typical terms and conditions of Private Money Mortgage Loans:

- Loan amounts range from $50,000 to millions of dollars

- Loan-to-Value (LTV) ratios are typically lower than traditional bank loans, averaging around 65%-75% of the property’s value

- Interest rates are higher than traditional bank loans, ranging from 8% to 15%

- Loan terms are shorter, typically 6 to 18 months, but can be extended for up to five years

- Borrowers are charged origination fees, typically ranging from 1% to 5% of the loan amount

Who are Private Money Mortgage Loans best suited for?

Private Money Mortgage Loans are best suited for borrowers who are unable to secure traditional bank financing for various reasons. These reasons may include:

- Poor credit score or credit history

- Insufficient income or cash reserves

- Self-employment or irregular income sources

- Non-owner-occupied properties

- Pre-foreclosure or distressed properties

Private Money Mortgage Loans are also popular among real estate investors who need quick financing to acquire properties, rehab them, and flip them for a profit. These loans are typically faster to obtain than traditional bank loans, and they allow investors to act quickly on investment opportunities.

At Franklin Mortgage Holdings, we specialize in Private Money Mortgage Loans. Contact us today to learn more about how we can help you secure the financing you need for your real estate investments.